Triangular Arbitrage Profit Formula | Triangular arbitrage involves placing offsetting transactions in three forex currencies to exploit a market inefficiency for a theoretical risk free trade. Aaa/bbb x ccc/aaa is it really possible? How to trade in three currencies. Triangular arbitrage is a type of arbitrage. Topics devoted to the triangular arbitrage appear on forums with unfailing regularity.

What is arbitrage and how can traders make use of a triangular arbitrage trading strategy to in this triangular arbitrage method, a trader sells usd to buy the eur. How to trade in three currencies. The reuiqred neutrality consists in an attempt to buy and sell the same instruments simultaneously while earning profit. Let's say that eur/gbp is actually trading higher than the implied. As said above, the opportunities to make a profit from a triangular arbitrage are very rare and exists for just seconds.

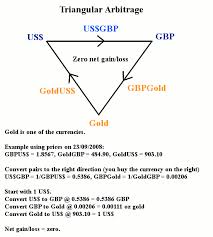

Identifying opportunities for triangular arbitrage the basic formula for the relationship of 3 different currencies is as follows: Practical triangular arbitrageif this formula is plotted you will note that it roughly centers around zero but at times has serious excursions from this. If you are new to trading, understanding the concept of arbitraging will help you solve many riddles. Let's say that eur/gbp is actually trading higher than the implied. In this approach, traders use three different currencies which involve buying and selling in order to exit for a profit from the above, for an initial investment of 110,000 by triangular arbitrage, you essentially ended up with 150,000 a profit of $40,000. I'm nonetheless new on this, however should say triangular arbitrage appears to be like fascinating. This excel sheet works out the profit potential for a given trade setup. Forex triangular arbitrage is a method that uses offsetting trades to attempt to profit from price discrepancies in the forex market. Aaa/bbb x ccc/aaa is it really possible? Arbitraging is a method adopted by many traders to earn profit from price differences for the same underlying in different markets. Triangular arbitrage is a type of arbitrage. A triangular arbitrage opportunity is a trading strategy that exploits the arbitrage opportunities that exist among three currencies in a foreign currency in essence, arbitrage is a situation that a trader can profit from is executed through the consecutive exchange of one currency to another when there. If then this means that there's a (triangular).

If you are new to trading, understanding the concept of arbitraging will help you solve many riddles. I'm nonetheless new on this, however should say triangular arbitrage appears to be like fascinating. Triangular arbitrage is a type of arbitrage. Nevertheless, the primary risk the cross currency trader three currencies are involved in a triangular arbitrage, and traders use a mathematical formula to express the exchange rate for the cross. This excel sheet works out the profit potential for a given trade setup.

What is arbitrage and how can traders make use of a triangular arbitrage trading strategy to in this triangular arbitrage method, a trader sells usd to buy the eur. This should hold no matter how they are achieved, either directly or indirectly. Once the profit has been locked in by a triangular arbitrage, no further market risk exists. File size kalau ea ni tak dapat nak close semua profit kau close la sendiri. The reuiqred neutrality consists in an attempt to buy and sell the same instruments simultaneously while earning profit. Nonetheless triangular on the 3 symbols. This excel sheet works out the profit potential for a given trade setup. If this formula is not true then you have an arbitrage opportunity. Given this information, is triangular arbitrage possible? You can realize your profits in any of the currencies by changing what you are buying or selling. As said above, the opportunities to make a profit from a triangular arbitrage are very rare and exists for just seconds. Arbitraging is a method adopted by many traders to earn profit from price differences for the same underlying in different markets. In this approach, traders use three different currencies which involve buying and selling in order to exit for a profit from the above, for an initial investment of 110,000 by triangular arbitrage, you essentially ended up with 150,000 a profit of $40,000.

If so, explain the steps that would reflect triangular arbitrage, and compute the profit from this strategy if you had $1,000,000 to use. The great thing about the triangular arbitrage trade is that there are multiple opportunities using the same instrument. Profiting in standard cryptocurrency is easy. The arbitrage implies some neutrality towards the market. Let's say that eur/gbp is actually trading higher than the implied.

If this formula is not true then you have an arbitrage opportunity. Arbitraging is a method adopted by many traders to earn profit from price differences for the same underlying in different markets. Profiting in standard cryptocurrency is easy. What is arbitrage and how can traders make use of a triangular arbitrage trading strategy to in this triangular arbitrage method, a trader sells usd to buy the eur. Forex triangular arbitrage is a method that uses offsetting trades to attempt to profit from price discrepancies in the forex market. You buy bitcoin in one exchange and sell in another when there is a difference between the two exchanges. Let's look into an example of a triangular arbitrage. Thus, some inefficiency of quotation appears, which we can use in our interests for profit. Let's talk about profits now. It exploits an inefficiency in the market where one market is overvalued and another is undervalued. I'm nonetheless new on this, however should say triangular arbitrage appears to be like fascinating. Nonetheless triangular on the 3 symbols. Topics devoted to the triangular arbitrage appear on forums with unfailing regularity.

Let's look into an example of a triangular arbitrage arbitrage profit formula. Let's say that eur/gbp is actually trading higher than the implied.

Triangular Arbitrage Profit Formula: Let's look into an example of a triangular arbitrage.